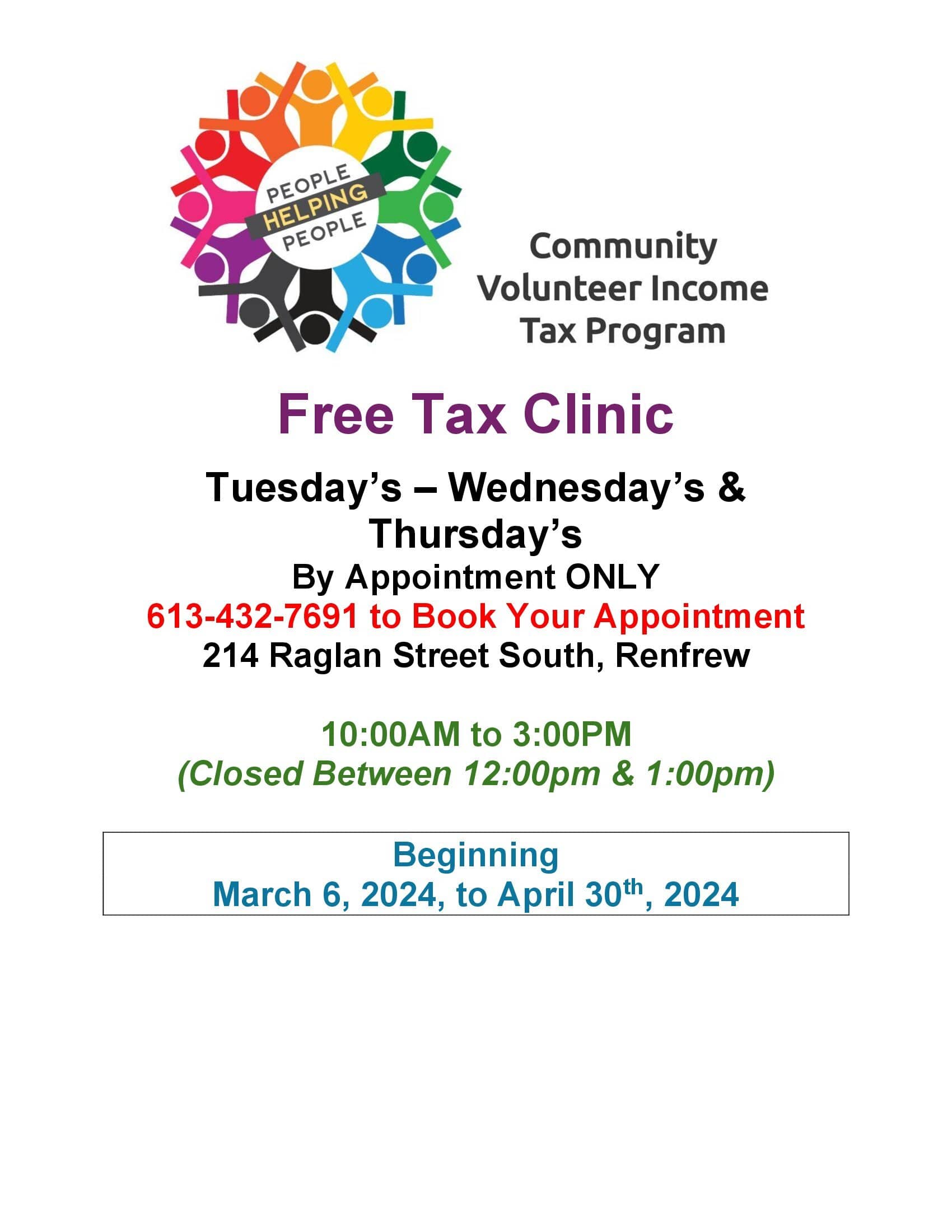

Community Volunteer Income Tax Program

Beginning Wednesday, March 6, 2024 till Friday, April 30, 2024.

This Year’s Tax Clinic is by Appointment ONLY by calling Renfrew and Area Seniors’ Home Support at 613-432-7691 Tuesday – Wednesday – Thursday 10:00 am – 3:00 pm (Closed 12:00pm to 1:00pm)

Pick up of completed RETURNS will be by appointment only as well, and must be picked up by Friday, May 3, 2024.

Client Checklist:

Only the client or his/her Power of Attorney can bring in the Income Tax Forms

Gross Income thresholds for filing your 2023 Taxes at our Community Volunteer Income Tax Clinic.

$35,000 or less for a single person who has no dependents.

$45,000 or less for a single parent and 1 child plus $2500 per additional dependent.

$45,000 or less for a couple plus $2,500 per dependent.

Please ensure you bring the following documents.

- (2022) Last year’s Notice of Assessment or

- (2022) Last year’s Income Tax Return

- Rent Receipts/Property Tax Information

- Senior Property Tax Rebate Confirmation Letter

- Medical Receipts

- Charitable Donation Receipts

- T4, Statement of Remuneration Paid

- T4A, Statement of Pension, Retirement, Annuity, and other Income

- T4E, Statement of Employment Income and Benefits

- T5007, Statement of BenefitsT5, Statement of Investment Income

- Canada Child Benefit

- SeniorsT4A (OAS), Statement of Old Age Security

- T4A (P), Statement of Canada Pension Plan Benefits

- T4RSP, Statement of RRSP Income

- T4RIF, Statement of Income from a Registered Retirement Income Fund

(First and Last Name of Child, Date of Birth, S.I.N. Card, Health Card) (Female or Male)

We CANNOT complete your tax return if:

- You are self-employed

- You have rental income

- You have claimed bankruptcy

- You have capital gains/losses

If you do not have the above documents, please call Canada Revenue Agency Phone: 1-800-267-6999